Contents

U.S. jobless claims back over 1 million

After registering below 1 million for the first time since March last week, initial jobless claims are once again above this key level.

Claims for unemployment benefits rose to 1.106 million for the week which ended Aug 15th, an increase from last week’s revised figure of 971,000.

Although the expectation was for claims to continue to decline, with early estimates suggesting 925,000 applications. The rise highlights a setback for a struggling U.S. job market crippled by the coronavirus pandemic.

The Dow Jones was down 0.28%, S&P 500 fell by 0.11%, and the NASDAQ slipped by 0.34% on the news.

DAX falls as COVID-19 cases rise in Europe

Germany and Spain both have recorded their highest daily increases in coronavirus cases since April.

Spain currently has the highest case numbers in Europe with a reported 3,715 new cases of the virus confirmed within the past 24 hours.

Germany has seen cases move to 1,707 in the same period. This resurgence in European COVID-19 cases has led several countries to re-impose travel restrictions, on visitors from these nations.

The DAX fell by 1.14% today.

Alibaba earnings beat expectations

In recent weeks, several U.S. tech companies have all reported better than expected second quarter earnings, today was the turn of Chinese heavyweight Alibaba to do the same.

The company reported that sales from its ecommerce business alone jumped 34% to 133.32 billion yuan.

Alibaba has seen its stock rise by over 23% this year.

The news comes on the day that U.S. and Chinese officials have backtracked and made new commitments toward further trade talks.

Quote of the day: “It’s not what we do once in a while that shapes our lives. It’s what we do consistently.”

Tony Robbins

Biggest Bull

GBPUSD: After hitting the 1.3092 floor yesterday, GBPUSD rebounded big today, climbing to an intraday high of over 1.31960.

Biggest Bear

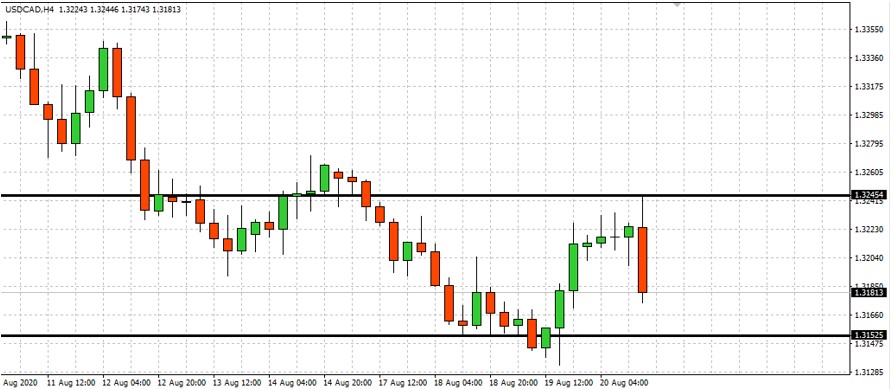

USDCAD: Unable to break the resistance level of 1.3245 yesterday, sellers today entered USDCAD, taking it to as low as 1.3173 shortly after the opening bell in the US.