TRADEVIEW MARKETVIEW Week Commencing March 2nd 2020

Contents

Market Overview

Last week saw the Coronavirus rapidly expand outside of China, leading to panic not only in streets around the world, but in the financial markets where we saw historical moves take place. The SP500 suffered one of its largest weeks of losses ever recorded, dropping close to 5% in 5 days of trade. Gold climbed up close to over $100 in value, reaching highs not seen since the crash of 2008/9. We saw several safe havens respond in similar fashion, with the Japanese Yen and Swiss Franc also recording rapid moves.

Most major indices especially in Europe fell, including the FTSE 100 and the DAX as Italy became one of the largest carriers of Coronavirus sufferers around the globe. With the airline industry slowing and tourism suffering, Crude Oil prices also hit lows not seen since November.

Market Preview

After the historical week in which we saw markets move at record speeds, this week is primed to potentially continue or end that trend. This however is all dependent on the pace in which the coronavirus continues to spread, or if the WHO and major world powers find a way to slow infections.

As it is also the first week of the new month, traders will also be looking towards Friday to see the employment numbers from the US as the NFP report is released. With the US signing a peace deal with the Taliban, and the Democratic candidate also to be announced, many hope that we could see markets start to rebound after a volatile week.

Irrespective of any of these potential moves, you are welcome to follow the trade opportunities they create on TradeGateHub!

Fundamental view

Tuesday: EUR Euro-Zone Consumer Price Index Estimate (YoY) (FEB)

Wednesday: CAD Bank of Canada Rate Decision (MAR 4)

Friday: USD Change in Non-farm Payrolls (FEB)

Technical view

XAUUSD – Daily Chart

After one of the biggest weeks of gains in the price of Gold, which many see as the world’s safe haven currency, many await to see what follows. Friday saw the metal start to decline in price, as the “what goes up, must come down” mantra rang down, as sellers saw the recent over buying as a chance to profit from the fall. Now back at $1585, which had been a previous resistance, the prospect of a bounce back towards the$1600, of further declines to the mid $1500s remains. Moving averages have been positioned for a downwards cross, even before last week’s rapid rise, however could this week see the fall start to truly take shape?

EURUSD – Daily Chart

EURUSD was another one of the other gainers last week, with the coronavirus heavily impacting the world’s most traded currency pairing. From a technical analysis perspective however you can see that the USD weakness which took place last week coincide with the $1.08 price floor, where traders had seen act as a buying zone on several occasions in the past. The support was not only in price however, but also within the volumes in this market as the RSI at 34 was once again held as it had been in the past 6 years.

Next week, traders may still see the opportunity to push this pair towards the $1.14 resistance as we are still relatively weak in volume, and the potential for moving averages to trend up.

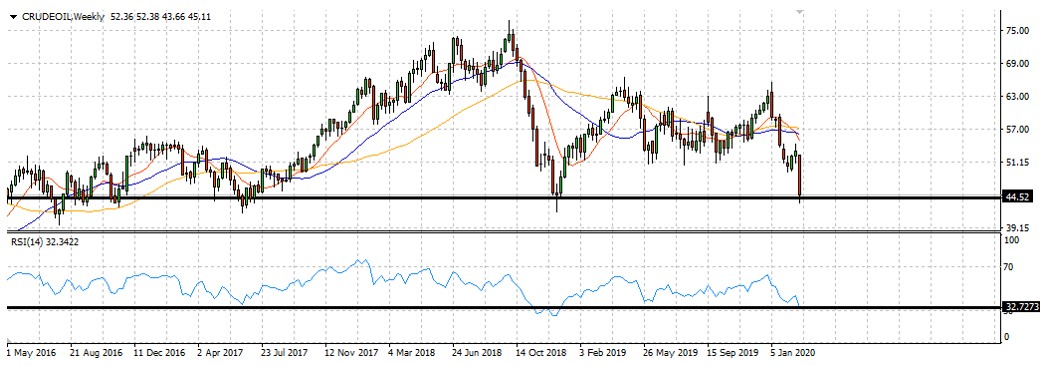

CrudeOil – Daily Chart

With flight cancellations every corner of the globe, and tourism especially within Asia falling, the demand for Crude Oil has suffered. The energy fell to it’s long term floor of $44.52 which was the last price in November of 2019. This fall has seen volumes reach oversold territory which haven’t been breached in the last 5 years. So although the fundamentals may say otherwise, the technicals suggest that this drop may be coming to a pause as buyers may be primed and ready for a rally increasing the price back to the $50 level. Traders across the board may be mistaken to see the situation with the Coronavirus as the main cause of upcoming price moves, however as we know with Oil there can be several given factors at any time.

Charts analysed and narrated by Eliman Dambell – edambell@tvmarkets.com